I’m not a stock trading pro… actually, I’m grateful and fortunate to have learned about investing during the 2007-8 recession.

Thanks to the advice of Chris Mechanic,, I opened a Roth IRA and put $500 in it (that was my “life savings” at that time).

My first stock trading experience didn’t teach me the best way to trade stocks – but it definitely got me excited about it!

I bought GGP (General Growth Properties). I don’t remember exactly why – but the fact that they were once $60/share and were selling for $0.35/share probably had something to do with it.

Remember, this was the depth of the 2007-8 recession – GGP had filed bankruptcy as they had several commercial real estate (that’s what they do) loans coming due and didn’t have the money nor could get the financing (because banks weren’t lending) to pay them.

Long story short, I made a good bit of money when they crawled out of bankruptcy. I still have some shares and plan to keep them for a long time… which leads me into the best way to trade stocks.

Easiest & Best Way To Trade Stocks

One of my friends saw the gains I made off GGP and asked: “Dude, what is the best way to trade stocks?” — This was my response to him:

I’m not a “day trader”, stock trading pro, nor do I always make the best decisions… shoot, I barely know what the difference between a 401k and an ira is!

If you have some extra money and want to trade stocks with it …

OR —

If you don’t trust the mutual funds or the “financial consultants” (like me) …

OR —

If you just want to know the easier, best way to trade stocks …

Follow these simple steps for quick & effective investing (note the investing):

- Invest in the companies that you use.

- Invest for the LOOOOOONNNG term.

- Have cash available to spread out your investments.

There is no need to “pick stocks” … Just invest in the companies that you use.

Don’t get me wrong, you want to invest in good companies.

Good companies make money, bad ones lose it. The whole goal here is to make money right?

How do you know what a good company to invest in is? —

Easy: If you use and are thrillingly happy with their products and/or services – that’s a good company to invest in.

Seems too simple? It is… but it works.

Trust me, you don’t want to care if the stock goes up and down; that will just give necessary stress. Good companies will go up, in the LONG term!

Which brings us to the next point: only invest for the long term!

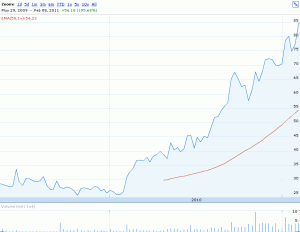

If the company has quality products and/or services, (all other things equal) it will gain stock price as time goes on.

Admittedly, there will be ups and downs – but I promise you that over time, the stock will go up!

Actually, those ups and downs can play to your advantage! How, you ask?

Well, if you have cash available to spread out your investments – You can capitalize on those ups and downs in a couple ways.

Let’s say you want to buy 100 shares of BAC (Bank of America). Instead of buying all 100 shares all at once, professional investors suggest spreading out your investment.

For instance, buy 20 shares today, 20 more in 2 weeks, wait a month and buy 40 more shares, then grab the last 20 shares 3 months later.

That way, you average your position to the general 6-month market price — instead of getting it all at ONE price.

In that 6 month period, the stock might drop significantly for a multitude of “short term reasons” — these include, but aren’t limited to: a bad quarter, raising capital, rumors/speculation.

Now, while you’re getting into a stock, you should pay attention to what’s happening. If the company announces that it’s going to fire half its employees or that it’s closing it’s doors — you don’t want to buy more share then… AND you will be happy that you didn’t buy all 100 shares at once!

Another reason to have cash on the sideline (going along with spreading the investments out) is to be able to get into a stock when you believe it’s “on sale”.

For instance, if Steve Jobs of Apple announces he is going to retire – the stock will take a hit. If you believe in Apple’s products, and you have cash available – you will be able to pick up Apple shares at say, 10-15% off. That 10-15% will come back, in time. How much time, who knows.. but I bet Apple doubles in price over the next 10 years.

Bonus Stock Trading Tip

I really hope this post helps you gain some confidence in trading stocks because I do believe it’s a very good idea (for the future).

But I do need to present the disclaimer:

Do NOT invest or trade stocks with money that you cannot afford to lose. I hate to say it, but there is ALWAYS a risk of loosing your money.

If you need the money – don’t put it in the stock market.

Definitely keep some liquidity for emergency situations, and a savings account that has a plan (buy a house, car, etc..) — but any “extra” money goes to the investment account.

A RothIRA has a limit of $5k after-tax contributions per year — so throw 1k at it every 2 months and you’ll get there 🙂

If you want to learn about IRAs and 401ks – check out 401k for dummies or IRA for dummies

*** Disclaimer: the advice in this article cannot be held against me. This is just what I do, if it doesn’t work for you, that’s not my fault. If you cannot afford to lose the money, do not invest it. ***